At Benefit Resource Partners (BRP), we understand the federal government benefit package is unique. With that in mind, our firm developed specialized tools to assist you and other federal employees in understanding how these benefits work and to help build your financial reality around them.

With a process built on collaboration, our team works to help you achieve your best version of retirement. We will assist you in navigating through the federal benefits package and maximizing the opportunities inside—and outside—your benefit system.

Finding a partner to help plan your financial future is important. It’s time to take that first step toward your future.

Get to know us and how we can partner with you.

Our network of federal benefit-focused financial advisors and our proprietary resources help you expand your knowledge base on your federal benefits and ways to maximize your retirement income.

Once you’re empowered with the knowledge—you’ll feel confident in making informed decisions on the best path to help you reach your retirement financial goals.

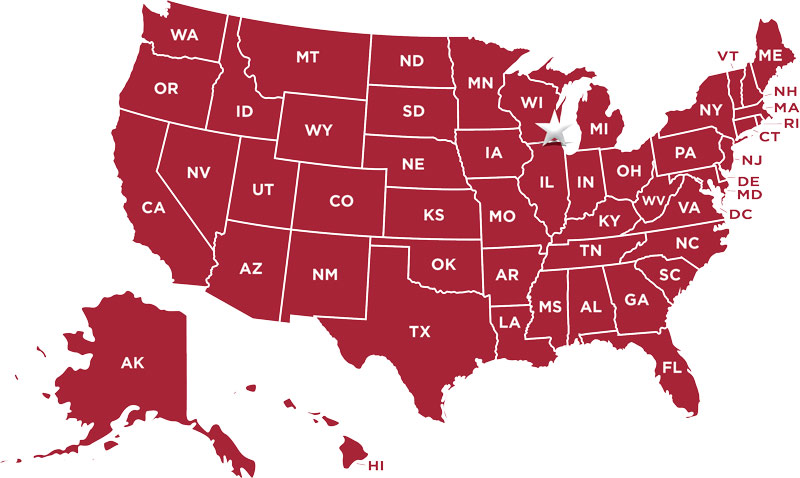

We’re here for

you every step of the way—

wherever you live.

Request your free BRP Federal Employee Benefit Workbook to get started on reaching your retirement financial goals. The workbook will assist you in these ways:

Fields marked with an * are required

Follow us on Facebook for the latest updates, strategies and tips for your Federal Retirement Benefits.

We are not affiliated with or endorsed by any government agency.

Investment advisory services offered through CreativeOne Wealth, LLC, a registered investment adviser. Benefit Wealth Partners and CreativeOne Wealth are not affiliated companies. We do not provide tax, legal or estate planning advice.

Investing involves risk, including possible loss of principal. No investment strategy can ensure a profit or guarantee against losses. Past performance may not be used to predict future results.

Licensed insurance professional. Insurance product guarantees are backed by the financial strength and claims-paying ability of the issuing company.

Investment advisory services are provided in accordance with a fiduciary duty of care and loyalty that includes putting your interests first and disclosing conflicts. Insurance services have a best interest standard which requires recommendations to be in your best interest. Advisors may receive commission for the sale of insurance and annuity products. Additional details including potential conflicts of interest are available in our firm’s ADV Part 2A and Form CRS (for advisory services) and the Insurance Agent Disclosure for Annuities form (for annuity recommendations).